Panama Papers leave a stink

The Panama Papers have revealed a mass of deceit within politics and money and business interests around the world. Will that have any impact on the forthcoming Australian election?

By HANNAH CLIFTON

Experts believe steps need to be taken to ensure a greater level of transparency in Australian politics, following the leak of the Panama Papers.

And the pressure could rise, with the planned release at 4am tomorrow (Tuesday AEDT) of the entire searchable database of documents, including details of the financial activities of hundreds of thousands of people and off shore entities. Go to https://offshoreleaks.icij.org.

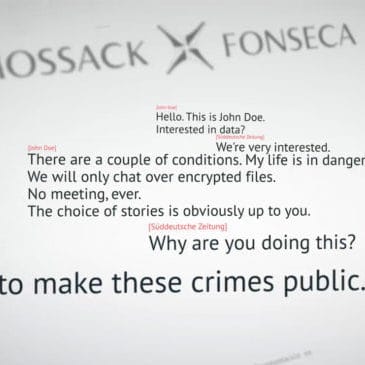

A large number of people in positions of wealth, power and leadership have been found to be using off-shore tax havens to hide income with the leak of documents from the Panamanian law firm Mossack Fonseca.

About 800 Australians are being investigated by the Tax Office in relation to the documents, it has also been reported.

With the Australian federal election set for July 2 and corruption fresh in voter’s minds, the question is whether this leak could affect the election’s outcome.

The Coalition is now trailing Labor 49 per cent to 51 per cent (two-party preferred) in the latest Morgan opinion poll, taken at the end of April/early May. But with a few weeks to go, things could still change.

Griffith University political scientist Professor Jason Sharman said voters were influenced by corruption, and that was even more true “when citizens see corruption among political leaders”.

After Iceland's Prime Minister Sigmundur David Gunnlaugsson resigned after being outed in the papers, leaders around the world have been releasing their tax returns to the public to demonstrate their legitimacy.

ANU lecturer Dr Andrew Hughes, an expert in political branding, said it was a trend we should be seeing in Australia.

“It’s already been a trend in America where the leading presidential candidates from all parties will declare how much they’ve earned in a financial year – but we haven’t seen it here yet, which is really interesting,” Dr Hughes said.

“I think that maybe what the Panama Papers will do in the future is that people who are in senior leadership positions of our political parties to each declare their income and be very transparent about their tax returns.”

A tax return will not necessarily display if someone has been avoiding tax. It's more likely that if a political authority refuses to release their tax return, it would raise suspicion of tax evasion or offshore accounts. This has been an element of many debates in the US, and still is in the current presidential race.

In 2015, Australia’s score on Transparency International’s Corruption Perception Index was 79 on a scale of 0-100, with 0 being "highly corrupt" and 100 being "very clean". This score has fallen from 85 in 2012.

The Coalition has traditionally supported business and shunned unions. But big businesses such as Wilson Security and BHP Billiton are among those that have been linked to the Panama Papers for tax avoidance.

Because of this, Dr Hughes said there was potential for the Panama Papers leak to affect the election.

“I think that what is really being revealed here is that the Government are definitely trying to make the case that there’s a link between bad behaviour in unions and Labor,” he said.

"But on the opposite side of things too, Labor is trying to make the connection between big business interests and the Government."

An open letter to Malcolm Turnbull from more than 40 prominent Australians was written in frustration over his silence following the leak. They have concerns about the Government allowing big business to continue to use shell companies and evade tax by not publicly outlawing it.

“The extent of the connection between money and dark money in politics has always been there but I think that it was never really a tangible one – it hadn’t been proven in the past,” Dr Hughes said.

"What the Panama Papers has done is really revealed that there is a more tangible connection – especially in some parts of the world – between politics and money and business interest – so its really quite revealing that context."

The Panama Papers website is at https://offshoreleaks.icij.org.