Does the comeback of Lorde and Babydoll tops mean we are in a recession?

There is a sense of worry the current economic situation is not as stable as hoped.

From indie sleaze to serif font, a flood of comical posts and memes on social media have been warning of an incoming recession. They claim the comeback of certain past trends are ‘recession indicators’.

Given the cost of living crisis and the rapid change of the global economy, some might think they’re right. But unless you’re an economist or a crypto bro, you might be asking: exactly what is a recession, and how do we know we’re in one?

lorde releasing music with lyrics about being 17 is a recession indicator— miss gender (@ananyussyyy) April 9, 2025

What is a recession?

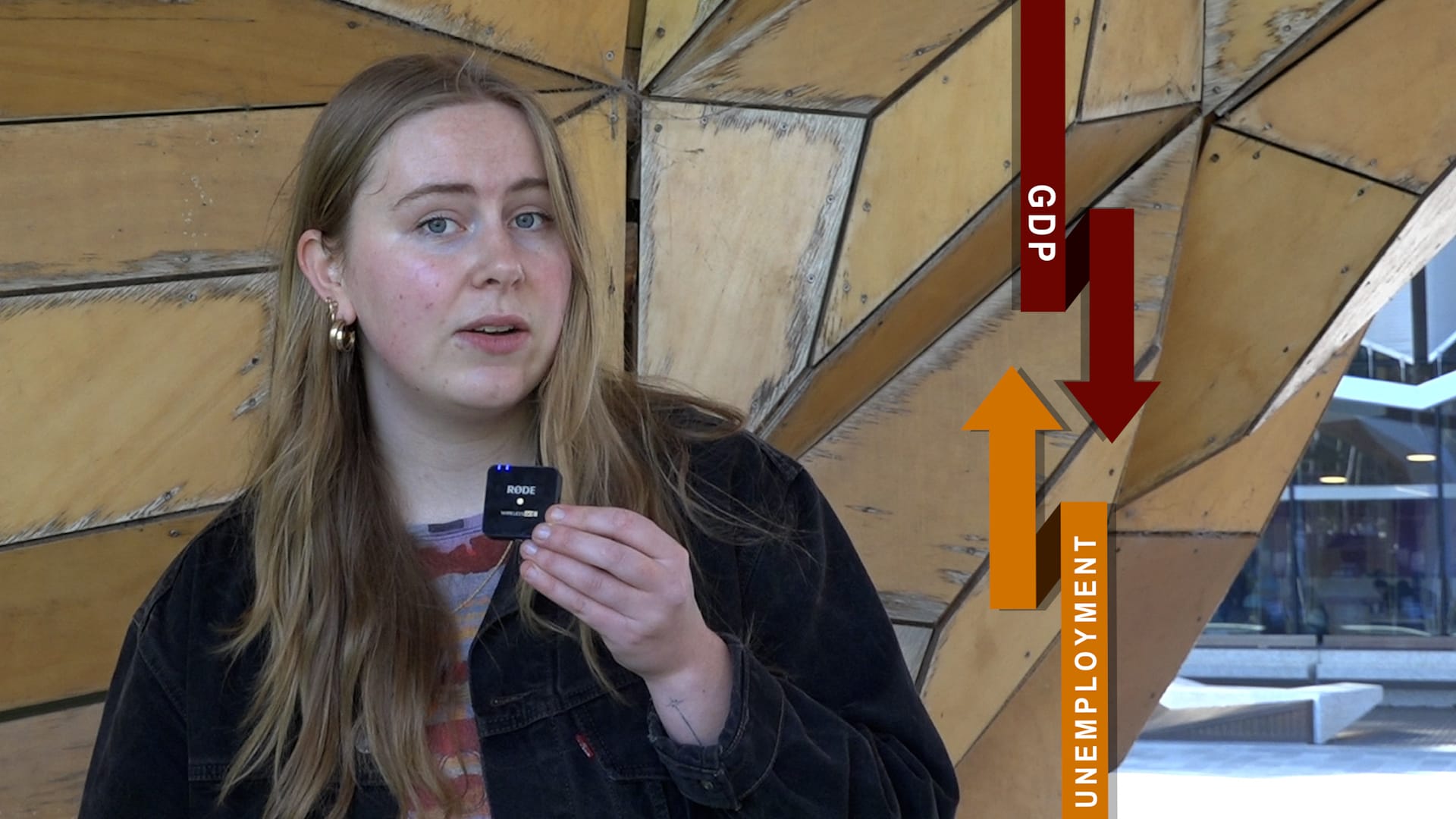

While there isn't a set definition of a recession, the Reserve Bank of Australia (RBA) defines it as a decrease in Gross Domestic Product (GDP) growth, paired with a high rise in unemployment.

Basically, the total value of goods and services a country produces (GDP) has to lower, while the rate of job loss rises, to be considered a recession.

Monash University Senior Lecturer in Economics Dr Isaac Gross refers to a recession as a period of economic downturn that affects society as a whole.

“A recession is a broad-base slowdown in the economy. Typically what you see is the unemployment rate rises, GDP falls, and we all get poorer as a result,” Gross said.

Economic ups and downs can be normal but, as the Reserve Bank of Australia explains, when an economic downturn is recorded for two or more quarters it is officially classified as a technical recession.

High quality American folk music is a recession indicator. Please be aware of any of your friends suddenly reapplying themselves to the banjo— microplastics dedicator (@irregulargrapes) June 7, 2025

Are we in a recession?

Not yet. According to the Australian Bureau of Statistics (ABS), Australia’s GDP has seen positive growth of 0.6 per cent in the latest quarter and by 1.8 per cent since June 2024 of last year.

Gross said that while this isn’t an outstanding result, it’s also not cause for concern.

“It’s not growing as fast as we’d ideally like, but if it’s not falling, that’s generally a strong sign,” he said.

As far as rising unemployment rates, ABS data show an increase from 4.0 per cent to 4.3 per cent between December 2024 and August 2025.

While that may seem high, Gross said Australian unemployment is at a "historically low level" and that it would take the rise of a full half percentage point (i.e. from 4.0 to 4.5 per cent) to be a serious indicator of an incoming recession.

While economists generally consider low GDP and high unemployment to be the most reliable evidence for a recession, there can be other indicators.

The RBA says that low household spending, business investment and loan payback rates also can show oncoming economic downfall.

However, even the RBA says traditional indicators can be unreliable, as GDP can be volatile and economic data can often be reviewed after its release.

Because of this, Gross said that incoming recession analysis can also come down to the mood of the collective people, not just the numbers.

“[Economists] look at survey data as well, survey and business confidence, consumer confidence, how people are feeling. They don’t always tell you if a recession is happening, but they’re pretty good indicators as to where the economy is heading,” he said.

Are these trends actually recession indicators?

Economic uncertainty may have led to non-traditional recession indicators becoming more popular, and some might even hold weight. Lipstick sales going up has often correlated with recessions, leading economists to jokingly refer to it as another recession indicator.

“[Lipstick is] supposed to be a relatively affordable way of splashing out in a way that doesn’t break the bank balance,” explained Gross.

Another more controversial example is an American sex worker who made headlines in 2012 by correctly predicting the incoming recession based on a decline in her profits.

More people could be looking to trends from previous times of economic unrest as a sign of history repeating itself. Indie sleaze, Babydoll tops and Lorde all were trending topics during the 2008 GFC, and while most recession indicator claims are humorous, there is a sense of worry that the current economic situation is not as stable as hoped.

Gross said that while they can be based on a historical factor, recession indicators often reflect the economic mood of the people.

“You might not be splashing out on expensive theatre tickets, but if your cheap local artist has put something out … those things are cheap and affordable, the sort of things you would typically consume during a recession,” he said.

While the economy feels increasingly daunting and even unapproachable for young people, this trend may be a way of making light of a period of uncertainty. As Gross explains, recessions are ultimately shaped by people, not just data. Therefore, if enough of the Australian youth feel economically hard done by, it’s not unreasonable for them to feel that a recession might be lurking.

We’re not in a recession yet, but only time will tell whether these non-traditional recession indicators actually hold any weight.